Biometric Verification for Bank Accounts & Mobile Wallets in Pakistan: 10 Essential Insights

Introduction to Biometric Verification

In today’s digital era, where cyber threats are growing at an unprecedented pace, biometric verification in Pakistan has emerged as a cornerstone of financial security. Whether you’re opening a bank account or registering for a mobile wallet like Easypaisa or JazzCash, Bank Account Biometric Verification ensures that your identity is accurately authenticated.

Biometric systems rely on unique human traits—like fingerprints, facial features, or even iris patterns—to confirm your identity. Unlike passwords or PINs, which can be stolen or hacked, biometric data is much harder to duplicate. This makes it one of the most secure methods to prevent fraud in Pakistan’s financial ecosystem.

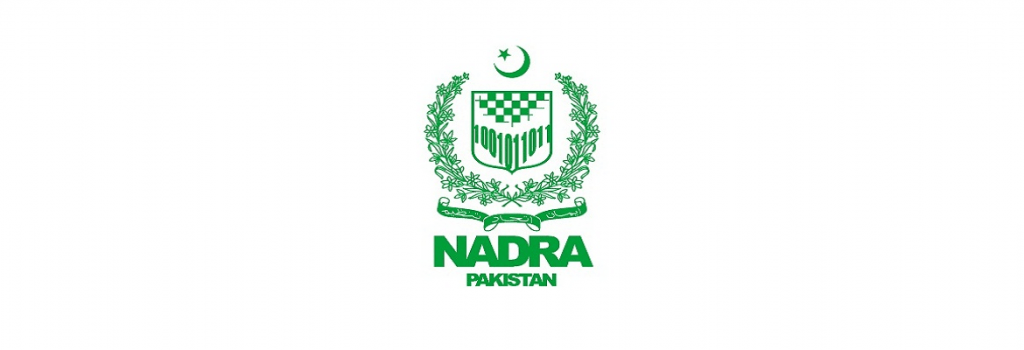

Over the last decade, regulatory authorities like the State Bank of Pakistan (SBP) and the National Database and Registration Authority (NADRA) have made biometric verification mandatory for financial transactions. This move has not only improved customer trust but also enhanced financial inclusion by allowing more people from rural and urban areas to safely access banking and digital wallet services.

Why Biometric Verification is Essential in Pakistan

Rising Cyber Threats

Cybercrime is on the rise in Pakistan, with fraudsters targeting banks, online wallets, and digital transactions. Additionally, Hackers often exploit weak PINs or passwords, but biometric authentication significantly reduces the risk by requiring a physical identity match.

Regulatory Requirements

Basically, the State Bank of Pakistan has made biometric verification mandatory for account openings and mobile wallet registrations. NADRA plays a critical role by maintaining the central database of citizens’ biometric data. This ensures that only legitimate customers can access financial services.

How Biometric Verification Works

Fingerprint Scanning

Pakistan’s biometric system mostly uses Fingerprint biometrics in biometric verification works. In addition, Banks and mobile wallet agents use fingerprint scanners linked to NADRA’s database to authenticate individuals.

Facial Recognition

Facial recognition is used for online verifications with the rise of smartphones. This technology is expected to grow with AI integration, providing a seamless customer experience.

Database Matching with NADRA

Every biometric verification request is matched against NADRA’s centralized database. Moreover, if the data matches, the transaction is approved; otherwise, it’s flagged for review.

Biometric Verification for Bank Accounts

Account Opening Requirements

Similarly, every individual opening a new bank account in Pakistan must undergo biometric verification at the branch. This ensures that no fake or duplicate accounts are created.

Existing Customers’ Verification

Older account holders were required to update their records with biometric verification during SBP’s directives in recent years.

ATM and Branch Security

Some banks have integrated biometric systems at ATMs, reducing risks associated with stolen debit cards or PIN codes.

Biometric Verification for Mobile Wallets

Popular Mobile Wallets in Pakistan

However, Easypaisa, JazzCash, UBL Omni, and HBL Konnect are among the most popular mobile wallets in Pakistan.

Verification Process for Easypaisa, JazzCash, and Others

To register a wallet, customers must provide their CNIC and verify their fingerprints via NADRA’s biometric system. Without this step, wallets have restricted functionality.

Limitations Without Biometric Verification

Unverified wallets have limited transactions, cannot store large sums, and often face restrictions on sending or receiving funds.

Step-by-Step Guide: How to Verify Your Account

- Visit your nearest bank branch or mobile wallet agent.

- Provide your original CNIC.

- Place your thumb or finger on the biometric scanner.

- The system matches your data with NADRA’s records.

- Upon successful verification, your account is activated or upgraded.

Benefits of Biometric Verification

Security and Fraud Prevention

Biometric verification prevents identity theft, SIM fraud, and unauthorized financial access.

Financial Inclusion

Millions of unbanked citizens can now safely access financial services with minimal paperwork.

Customer Trust

Mostly, customers feel more confident using banks and mobile wallets that prioritize secure transactions.

Challenges in Implementation

Rural Connectivity Issues

Biometric systems require stable internet connectivity, which can be challenging in remote areas of Pakistan.

Database Accuracy

Probably, errors in NADRA’s database, such as incorrect fingerprints or outdated records, can delay verifications.

System Downtimes

Occasional server failures or power outages can disrupt verification processes.

Government & Regulatory Role

State Bank of Pakistan (SBP) Directives

The SBP ensures that all banks and mobile wallets comply with biometric verification rules to combat fraud and money laundering.

Role of NADRA

NADRA maintains Pakistan’s centralized biometric database and provides verification services to banks, telecoms, and wallet providers.

Future of Biometric Verification in Pakistan

AI & Machine Learning Integration

Future systems will use AI to improve accuracy in facial recognition and fraud detection.

Cross-Platform Verification

Pakistan is moving toward a unified system where one biometric verification could work across banks, wallets, and telecom services.

External Resources

FAQs

It prevents fraud, ensures regulatory compliance, and builds customer trust in financial systems.

No, SBP has made biometric verification mandatory for all account openings.

Visit an Easypaisa agent with your CNIC, and they’ll complete the fingerprint verification process.

You may need to update your CNIC records with NADRA or retry at a different branch/agent.

No, the process is free for customers.

Overall plans include AI-driven facial recognition for online verifications.

NOTE: Learn how to Sim number Registration with CNIC Online 2025

Conclusion

Therefore, Bank Account Biometric Verification has become the backbone of financial security in Pakistan. From banks to mobile wallets, this system ensures that only verified individuals can access financial services. While challenges like rural connectivity and database errors exist, the benefits far outweigh the drawbacks. In short, as AI and cross-platform integration come into focus, Pakistan is moving toward a more secure and inclusive financial future.