Silver Is Quietly Entering a New Bull Phase — Here’s the Exact Moment the Trend Changed

Introduction — A Quiet Moment With Big Meaning

There are moments in markets that feel ordinary, yet later reveal themselves as truly historic.

Late in 2025 and into early 2026, silver quietly broke through levels that had once seemed distant dreams. Gone were the days when it sat between $25 and $35 an ounce for years. Instead, it began to climb steadily at first, then rapidly — finally entering what feels like a new bull phase in global markets.

This isn’t hype. It’s a trend backed by data, industrial demand, and global economic shifts.

When Did This Trend Really Begin?

If you rewind to early 2025, silver was trading near the high-$20s per ounce after years of relative calm. It was stable, sure, but hardly exciting.

But as the year progressed, prices climbed — slowly at first. By mid-2025, silver had risen to above $40. Then, toward the end of the year, the pace picked up significantly, with prices breaking longstanding resistance levels.

By December 2025, silver had more than doubled from its price at the start of the year — a truly remarkable surge that outpaced most other assets. This was the first clear signal that something structural was shifting.

Then came 2026:

• Silver crossed $80 and $90 per ounce multiple times.

• It even broke past $100 per ounce in late January — a milestone few expected this soon.

That’s not just a short-lived spike —

That’s a bull phase in progress.

Why This Rally Feels Different

So what changed?

This surge isn’t only about investors buying metal. It’s about the real world needing silver more than ever.

Here’s why:

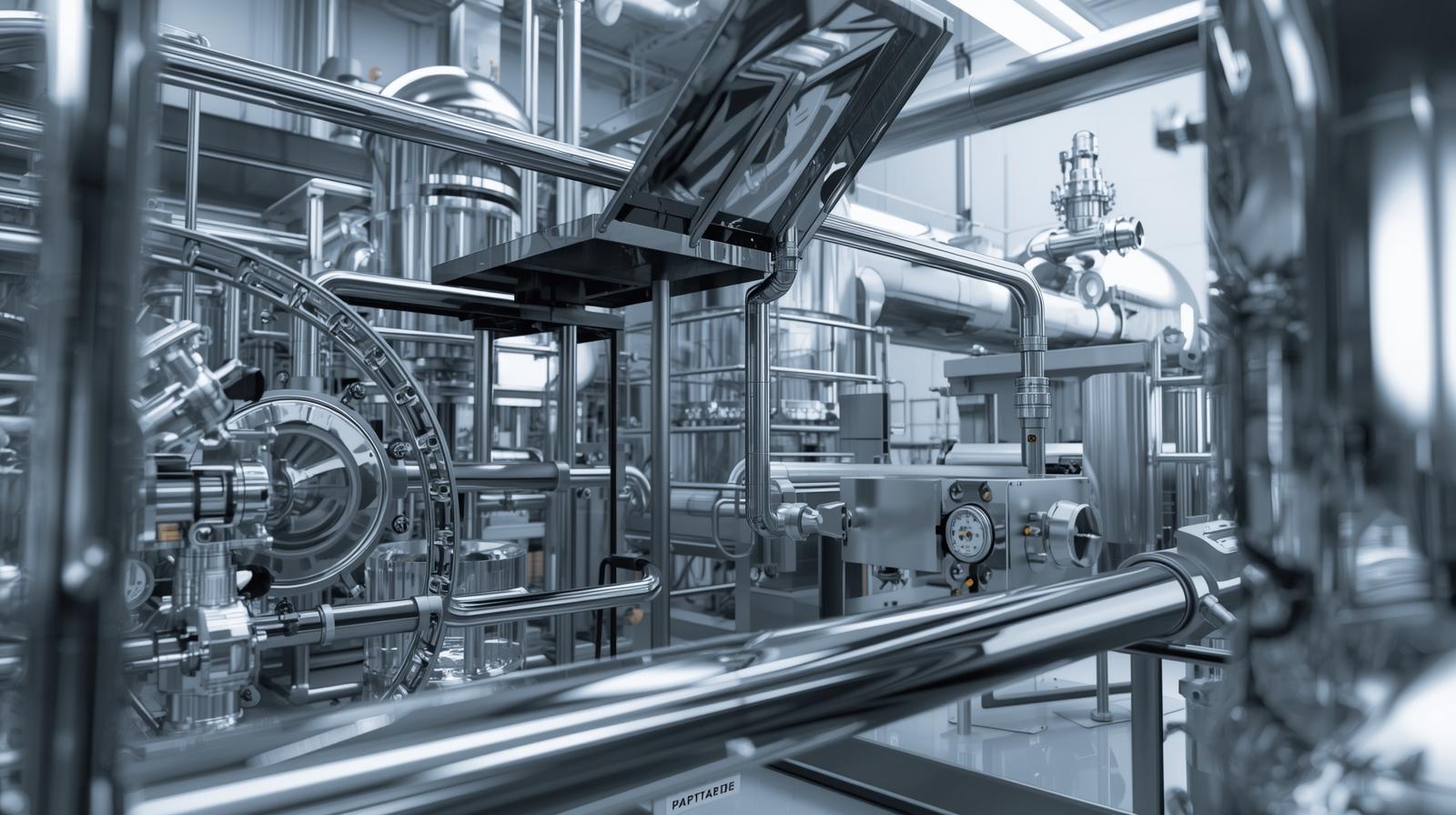

🔹 Industrial Demand Has Exploded

Silver isn’t just for jewelry and coins anymore. It’s essential in solar panels, electric vehicles, semiconductors, and even AI-related technologies. Experts say this demand is expected to remain strong through 2026 and beyond.

🔹 Supply Hasn’t Kept Up

Unlike gold, most silver is produced as a by-product of other mining activities — meaning supply doesn’t respond quickly to price increases. This has kept silver markets tight.

🔹 Safe-Haven Appeal

Geopolitical uncertainties and monetary policy shifts have pushed more people toward precious metals as a store of value. Silver has become a compelling choice because it’s cheaper than gold yet shares similar benefits.

When all these forces combine, prices don’t just go up — they accelerate.

The Emotional Story Behind the Numbers

Imagine this:

A few years ago, silver was something many people overlooked — something talked about mainly by specialists. But as global economic uncertainty increased and new technologies demanded more of it, ordinary investors began to notice.

Suddenly, conversations about silver weren’t in dusty metal forums — they were in everyday discussions about solar panels, climate tech, and retirement planning. That shift, that deeper human interest, is what gives momentum to the trend.

What the Data Says Today

Here’s where we stand in early 2026:

Silver price is around $90–100 per ounce on major exchanges.

Prices have risen over 200% year-over-year from 2025 levels.

Forecast models still see strong support for elevated prices through the year.

These figures aren’t random — they reflect supply-demand imbalances and strategic value in a changing world.

What This Means for You

Even if you’re new to markets, here’s the simple takeaway:

Silver is not just moving —

It’s trending, backed by real economic forces. It’s being pulled up by real demand from technologies affecting everyday life — solar energy, electric vehicles, and digital infrastructure.

This shift affects not just traders, but everyday people too — from jewellers to builders of green tech, and regular investors wondering how to protect their savings.

Key Takeaways (Quick & Clear)

✔ A new silver bull phase began in 2025 and continued into 2026.

✔ Prices have risen sharply, crossing historical levels.

✔ The market is driven by industrial demand, supply limits, and geopolitical forces.

✔ Experts expect continued strength through 2026, though volatility remains part of the picture.