Why Platinum Is Quietly Coming Back After Years of Being Ignored

Platinum Never Disappeared — It Just Fell Silent

For a long time, platinum felt forgotten.

Gold took the spotlight.

Silver regained attention.

Platinum stayed quiet, working in the background while markets looked elsewhere.

Why Platinum Lost Attention in the First Place

Platinum’s decline wasn’t sudden.

It happened slowly, through shifting industries and changing technology.

When diesel demand weakened, platinum lost a major use case.

The market moved on — maybe too quickly.

The Problem With Ignoring Useful Metals

Platinum isn’t a trend metal.

It’s a functional metal.

And functional metals don’t disappear just because headlines change.

They wait.

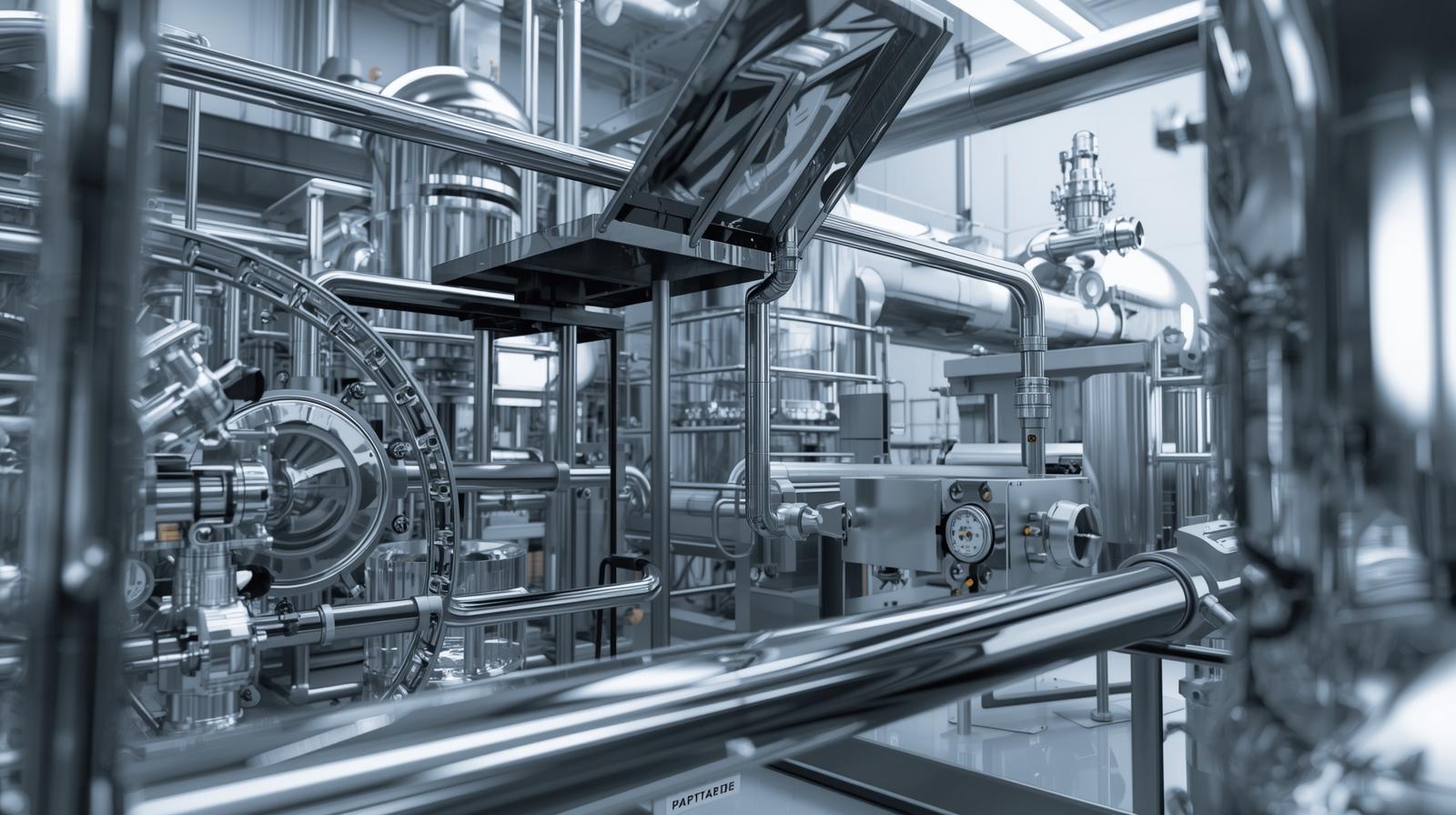

Where Platinum Is Still Essential Today

Platinum plays a critical role in:

- Emission control systems

- Industrial catalysts

- Medical devices

- Hydrogen fuel technology

These uses didn’t vanish — they evolved quietly.

Hydrogen Energy Changed the Conversation

Hydrogen needs efficient catalysts.

Platinum is one of the most reliable options available today.

As hydrogen projects expand globally, platinum demand re-enters the picture.

This isn’t speculation — it’s engineering reality.

Platinum’s Supply Is Tighter Than It Looks

Most platinum comes from a small number of regions.

Mining output is limited and slow to expand.

New supply doesn’t respond quickly to demand shifts.

That creates long-term sensitivity.

Platinum Is Often a By-Product, Not the Main Target

Many mines don’t extract platinum alone.

It comes alongside other metals.

That means production can’t be increased instantly even if prices rise.

Supply reacts late — not early.

Why Recycling Isn’t a Full Solution Yet

Platinum recycling exists.

But it depends on old industrial equipment reaching the end-of-life.

That process takes time and doesn’t scale overnight.

Recycling helps, but it doesn’t replace mining.

Why Investors Are Slowly Re-Evaluating Platinum

This isn’t a sudden rush.

It’s a reassessment.

Investors are noticing how platinum fits into future energy systems.

Quiet interest often precedes loud attention.

Platinum vs Gold: A Different Role Entirely

Gold stores value.

Platinum enables systems.

Comparing them directly misses the point.

Platinum’s relevance is tied to technology, not sentiment.

How Platinum Connects to the Bigger Metals Shift

Platinum doesn’t stand alone.

It moves with other strategic materials, shaping the next decade:

- Lithium powers energy storage

→ See The Lithium Supply Story No One Is Explaining Clearly - Copper carries electricity everywhere

→ Read Why Copper Is Becoming the Most Important Metal of the Next Decade - Rare earth metals enable AI and clean tech

→ Explore Rare Earth Metals: The Silent Backbone of AI and Clean Energy

This is a systems story, not isolated trends.

Why Platinum Demand Doesn’t Spike — It Builds

Platinum demand grows slowly.

It follows infrastructure, not emotions.

That makes it easy to ignore — until it becomes necessary.

That pattern repeats throughout history.

The Emotional Side of an Overlooked Metal

Markets chase excitement.

Platinum offers usefulness.

And usefulness rarely trends on social media.

But usefulness is what lasts.

Why Timing Matters More Than Headlines

Platinum isn’t about instant moves.

It’s about positioning within long-term shifts.

Energy transitions take years, not weeks.

This metal moves at that pace.

What Most People Miss About Platinum

Platinum doesn’t need hype to matter.

It just needs systems that rely on it.

Those systems are quietly expanding right now.

That’s the real story.

A Calm, Honest Takeaway

Platinum isn’t “back” in a dramatic way.

It’s being re-understood.

And re-understanding often happens before re-pricing.

Sometimes silence is the signal.