Why Silver Prices Are Rising Faster Than Expected in 2026 (It’s Not Just Inflation)

A Rally That Surprised Almost Everyone

At first, many people blamed inflation.

That felt like the easiest explanation.

But as silver kept climbing in early 2026 — faster and stronger than forecasts — it became clear that inflation alone couldn’t explain what was happening. Something deeper was pushing the market.

Silver wasn’t just reacting.

It was being pulled higher.

To understand why, we need to look beyond headlines and into how the real world now depends on this metal.

The Turning Point Came Before Prices Exploded

Before prices surged, signals were already there.

Industrial orders were increasing.

Long-term supply contracts were being locked in.

And silver inventories were quietly tightening.

This aligns closely with the moment explored in Silver Is Quietly Entering a New Bull Phase — Here’s the Exact Moment the Trend Changed, where the structural shift first became visible.

Prices followed later.

Demand came first.

Industrial Demand Is No Longer a Side Story

Silver used to be known mainly as a precious metal.

In 2026, it’s an industrial necessity.

Electronics, data centers, medical devices, batteries, and advanced manufacturing all rely on silver’s unmatched conductivity and durability. Unlike substitutes, silver performs reliably at scale.

Once industries adopt it, they can’t easily switch away.

That creates demand that doesn’t disappear during market pullbacks.

Green Energy Changed the Silver Equation

Solar energy has rewritten silver’s future.

Each solar panel uses silver for its conductive pathways. As governments push renewable targets and companies race to meet climate goals, solar manufacturing continues to expand aggressively.

This demand is not speculative.

It’s planned years in advance.

When solar production scales up, silver consumption rises with it — regardless of market sentiment.

That steady, unavoidable demand puts constant upward pressure on prices.

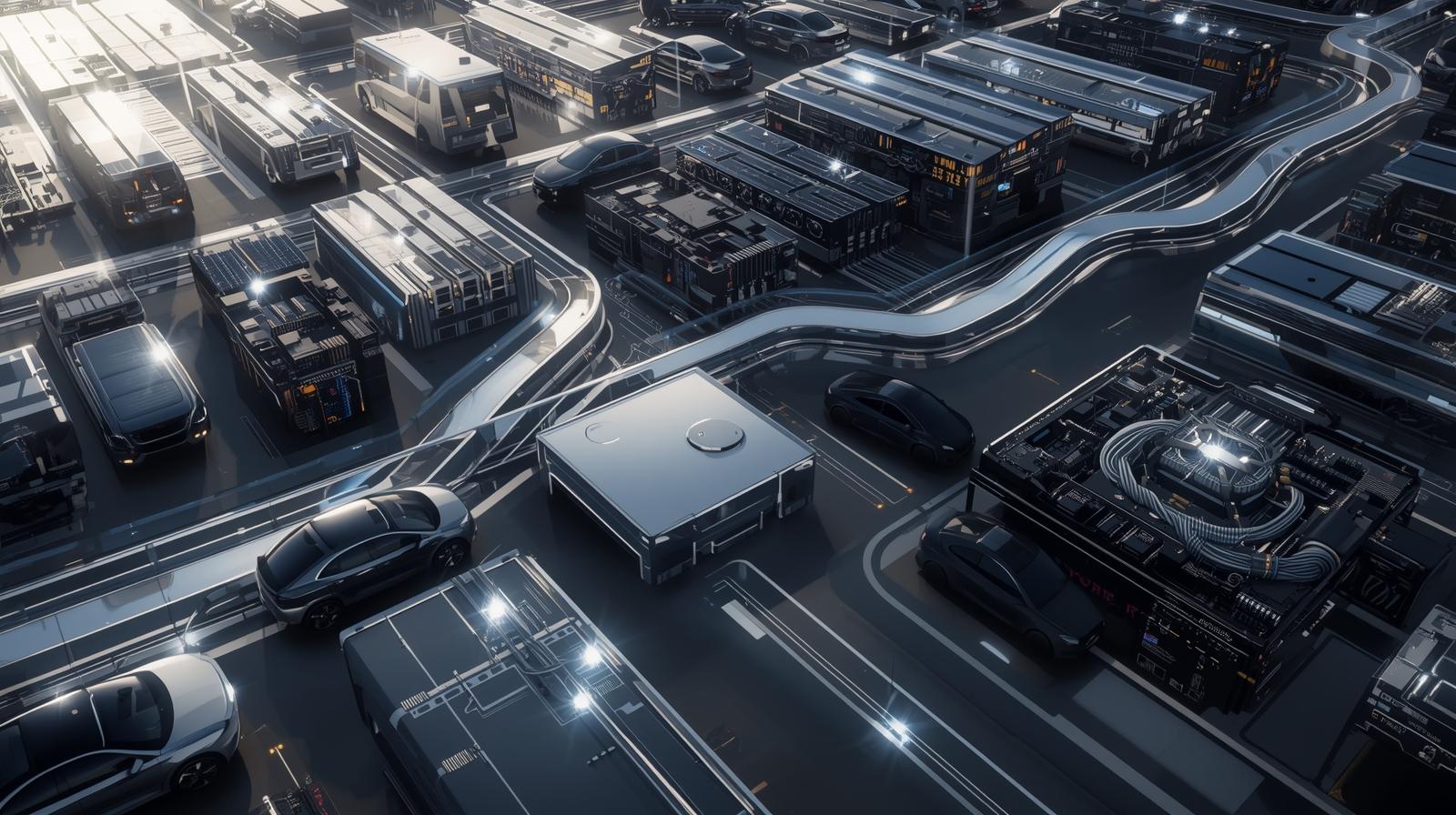

Electric Vehicles Added a Second Engine

Electric vehicles don’t just use batteries.

They rely on complex electrical systems that require silver for safety, efficiency, and longevity. From power distribution to onboard electronics, silver is embedded deeply in EV architecture.

As EV adoption accelerates globally, silver demand grows quietly in the background.

Unlike consumer investment demand, this use case doesn’t panic or sell.

It simply consumes.

Supply Pressure Is the Hidden Force

Here’s the part many people miss.

Most silver isn’t mined on its own.

It’s produced as a by-product of copper, zinc, and lead mining.

That means even when silver prices rise, supply can’t quickly respond unless other metals also justify increased production.

In 2026, that bottleneck matters more than ever.

Demand is flexible.

Supply is not.

This imbalance is one of the strongest forces pushing prices higher.

Recycling Can’t Fill the Gap

Some assume recycling will solve shortages.

In reality, recycled silver covers only a fraction of global demand. Much of the silver used in electronics is difficult or expensive to recover.

That limits how much secondary supply can help.

When new industries need more silver, they mostly rely on fresh supply, which is already constrained.

Investor Psychology Shifted Quietly

Something else changed in 2026.

Investors stopped viewing silver as a short-term trade and started treating it as a strategic asset.

Not because of hype.

Because the story finally made sense.

Silver now sits at the intersection of:

- Technology

- Energy transition

- Economic uncertainty

That combination attracts long-term capital, not just speculation.

When investors believe demand is structural, they hold longer, reducing selling pressure.

Silver Is No Longer “Just Cheaper Gold”

For years, silver lived in gold’s shadow.

In 2026, that relationship shifted.

Gold remains a store of value.

Silver became both a store of value and a critical industrial resource.

That dual role changes how markets price risk.

Silver doesn’t need fear alone to rise anymore.

It has real-world momentum.

Why Inflation Alone Doesn’t Explain This Move

Inflation affects many assets.

But not all assets double or triple while inflation remains relatively stable.

Silver’s rise has outpaced inflation indicators, currency moves, and even some commodities.

That tells us the market is pricing something else — long-term scarcity combined with rising usefulness.

Inflation may light the spark.

Fundamentals fuel the fire.

What This Means for the Trend Ahead

When price growth is driven by real demand, it behaves differently.

Corrections happen.

Volatility remains.

But the underlying direction tends to persist longer than most expect.

This is why the silver move feels stronger than previous cycles — and why many analysts believe the trend that began in 2025 still has room to develop.

Key Takeaways, Plain and Simple

Silver prices in 2026 are rising faster than expected because:

- Industrial demand is accelerating

- Green energy relies heavily on silver

- Supply growth is limited and slow

- Recycling cannot meet the new demand

- Investor behavior has shifted long-term

This is not a single-cause rally.

It’s a multi-layered transformation.